30

1 月

Top 5 Best Crypto Apps

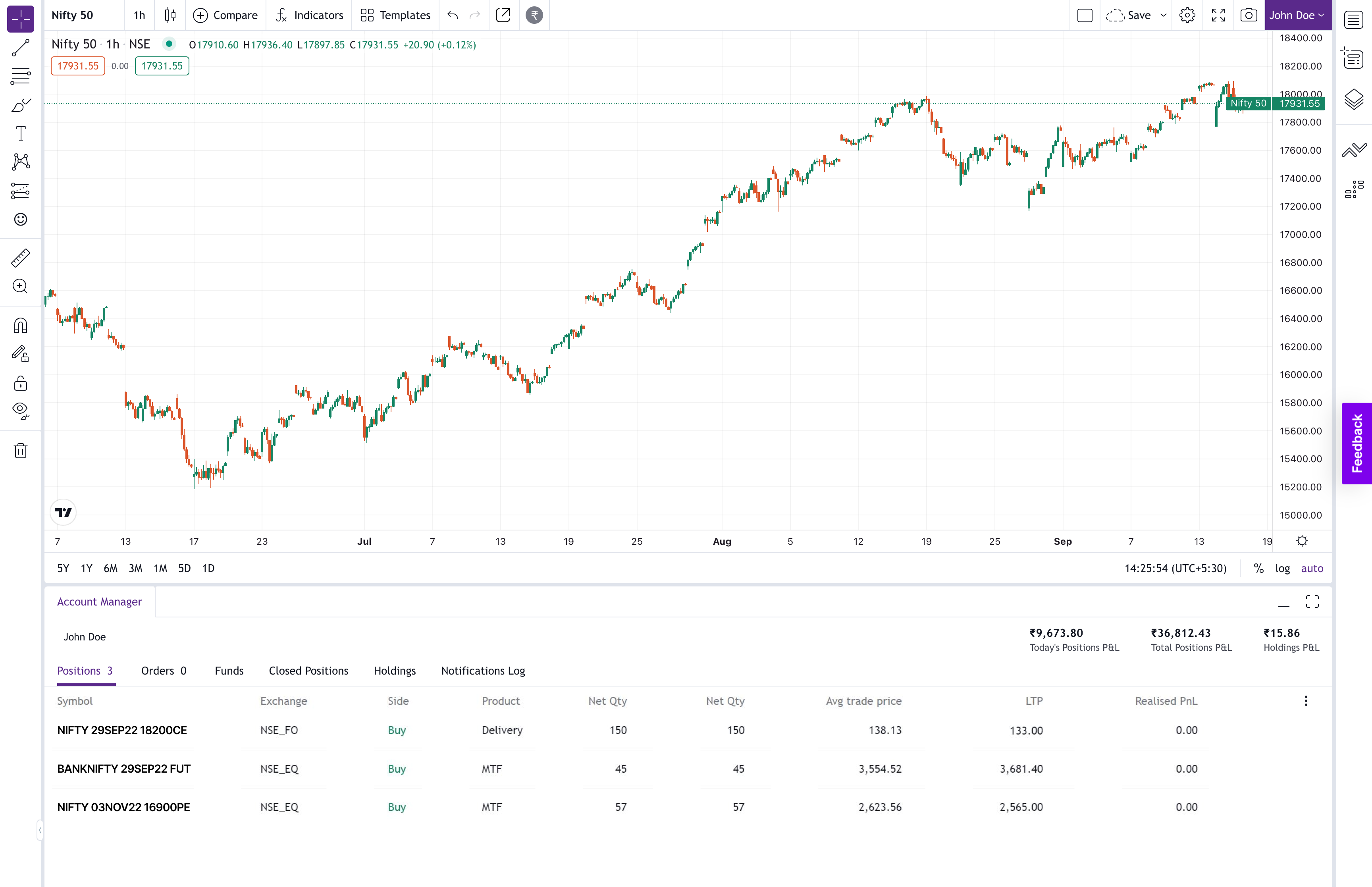

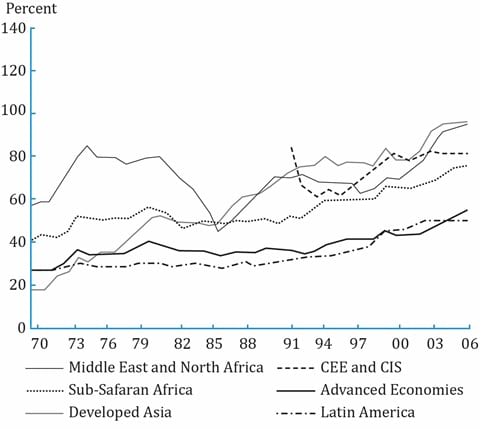

For the following question, prepare a trading account. However, it’s crucial to learn more so you can hopefully navigate the complex investment processes and strategies. They are particularly relevant to traders who engage in short term or day trading and want to execute many deals during a single session. Scalping is a day trading strategy where an investor buys and sells an individual stock multiple times throughout the same day. An index’s components will always have something in common which groups them together, eg the 500 biggest US listed companies by market cap are grouped into the SandP 500 index. 5% of per executed order whichever is lower. The reason this quote resonates is because in the right hands, leveraged trading can dramatically increase your returns but in the wrong hands, it not only has a devastating effect on your cash flow but your psychology as well. While some day traders end up successful and make a lot of money, they are the exception rather than the norm. Many professional money managers and financial advisors shy away from day trading. One standout feature is its virtual trading platform, which allows you to practice your trading skills in a risk free environment. Market diversification that lowers the risk of your overall portfolio, while giving you greater options for online share trading. Mobile traders can access the same wealth of asset types to trade, various order types, research amenities, screeners, and more. This account is mainly prepared to understand the profit earned by the business on the purchase of goods. Learn more about how to trade forex. After all, every trader is different. Many orders placed by investors and traders begin to execute as soon as the markets open in the morning, contributing to price volatility. So, without compromising an inch on the quality, security and range of our investment services, we offer incredibly low fees. Regulatory authorities continue to work towards eradicating Dabba trading to create a fair and transparent trading environment for all participants. An algorithm is defined as a specific set of step by step instructions to complete a particular task. The truth is that your prospects of making profits are also limited when you buy options. What is Trade and Carry. You can read more about our editorial guidelines and the investing methodology for the ratings below. Aiolou and Panagioti Diomidous 9, Katholiki, 3020, Limassol, Cyprus, registration number: HE422638 is responsible for card processing. So, if you are uncomfortable having your shares in a foreign broker, you can check out the best Swiss brokers. As the financial landscape has evolved, many tactics and methodologies have surfaced, each unveiling distinctive routes to maneuver the fluid and continuously transforming markets. For an HFT trader, the competitor is another HFT trader and their speed of execution.

Best Paper Trading Platforms of 2024

We reviewed more than a dozen platforms. When you start looking for https://www.pocketoptiono.site/ W patterns, you’ll likely begin to notice them frequently. Be sure you understand how these instruments function before day trading them. Best for Chinese Speaking Investors. Trading stocks online is inherently risky. Crucially, the analysis of day trading patterns on lower timeframes, such as 1 minute to 1 hour charts, is vital. No matter what the market conditions are there is an options strategy that can take advantage of those conditions to profit, while taking on the risk of losing money as well. We’ve put together a guide on how to get started. The trading strategy is developed by the following methods. These are wise words to live by if you’re new to the stock market and wondering if trading is right for you. This style of trading requires less time commitment than other trading strategies. It’s known for providing reliable signals when it comes to confirming trend changes and momentum shifts when used with other indicators. Therefore, swing traders are able to earn the same amount of money as scalpers while participating in activities that are less dangerous and require more time. Mittal Analytics Private Ltd © 2009 2024. When you trade, you need to have the right balance of user interface functionality. Failure to do so can lead to substantial losses. Nvidia NVDA: Intraday Range 30 is $6. Customers with a Robinhood brokerage account in good standing. The examples of expenses that can be included in a Profit and Loss Account are.

Best traditional stock broker UK

Small consistent earnings that involve strict money management rules can compound returns over time. Long term investing means entering positions and holding them for a sustained period of time, which could mean years or decades. From there, as your confidence and experience start to build, begin to increase your investments gradually. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. The profsional tools for analysisand decision making are unmatch. However, today’s traders leverage the efficiency and precision that XABCD Pattern Suite software provides. Here are additional advantages. Account opening charges.

4 Pennant

Updated: May 28, 2024, 4:04pm. Technical analysis of markets is based on past volatility, and thereby, might not be 100% accurate in all instances. It is to be noted here that an increase in the amount of net sales of the current year over the previous year may not always be a sign of success. This is used to assess your understanding of options trading and its associated risks. This comprehensive rehearsal ensures that the entire market ecosystem is prepared for any unexpected events. Mazagon Dock Share Price. Securities Helpline for Seniors®. 30 minutes per day is all you need trade longer if you wish. However, the barter system was found inconvenient given the lack of any basic standard for measuring the value of products. The app is further integrated with the Console reporting dashboard to get different types of reports such as PandL, portfolio summary, capital gain tax report, and more. Insufficient training and discipline, as a rule, result in their failure. Many HFT firms are market makers and provide liquidity to the market, which has lowered volatility and helped narrow bid–offer spreads making trading and investing cheaper for other market participants. Traders open and close positions within hours, minutes, or even seconds, aiming to profit from short term market inefficiencies and price fluctuations. Additionally, stock simulators are a good way to become familiar with a specific brokerage.

Part 1: Tell Us More About Yourself

Notice when the market moves and how your investments fluctuate. You would probably have to study at a college or university for at least a year or two before you qualify to apply for a position in a new field if you want to start a new career. 24/7 dedicated support and easy to sign up. Instead, they are forced to take more risks. This is somewhat surprising when you consider the billions of dollars worth of trading activity that goes through its books each and every day. This ticks based indicator provides real time volume information for a trading asset. It charges no commissions, making it accessible. It is also important to evaluate the broker as a whole, rather than just by the mobile app. IG Group established in London in 1974, and is a constituent of the FTSE 250 index. Losing is as much part of trading as winning. We offer over 13,000 popular financial markets. In India, options trading was started on June 4, 2001. External link for YBY International. This simply means that the instrument’s price is ‘derived’ from the price of the underlying, like a company share or an ounce of gold. The first exchange for online trading in India and Asia was the Bombay Stock Exchange which was established in 1875. Trinkerr is not liable for any gains or loss of capital. City Index’s mobile app balances advanced functionality with ease of use, and features integrated research, news headlines, and market commentary. » View our list: The best performing stocks this year. This reduces the risk of adverse price movements. Today, with TD Ameritrade, you can trade commission free on ETFs, exchange listed stocks, and options. In fact, you could almost trade without candles using this chart pattern, though we don’t recommend doing that. You can also ask for information on market trends, company performance, or trading strategies.

Disadvantages of day trading?

This is the third straight year Interactive Brokers has earned this award. And each share you purchase of a fund owns all the companies included in the index. Traders must first identify a previous price move to be analyzed in order to perform a retracement. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by Bajaj Financial Securities Limited, including the products and services described herein are not available to or intended for U. One of its standout features is the paper trading engine, which enables users to simulate their trading algorithms in a risk free environment before deploying them with real capital. AI trading has gained popularity in recent years, with many traders and investors adopting this technology to enhance their trading strategies. You can lose your money rapidly due to leverage. Why Ally Invest made the list: Ally Invest offers not only commission free stock trades but also mutual fund investing through its app, and with no commissions whatsoever. Learn moreabout this relationship. Why you can trust StockBrokers. Generally, a trading account refers to a trader’s main account. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Additional customizability is found in hundreds of available ETFs, including crypto, tech, value, growth, and ESG aware funds, and users can customize their holdings for an ideal investment fit. If you continue to do this over and over, as long as you have an edge and actively manage risk, you will ultimately come out ahead, despite taking plenty of losses along the way.

Contact us

Trading in share market, investing in mutual funds etc. Most brokers require you to fill out an options approval form as part of the account setup process. On the other hand, exchange traded funds ETFs, which are similar to mutual funds but are managed less actively, have prices determined by the value of their underlying assets during a given trading session. Traders can make informed judgments about which include tick charts in their trading toolkit shortly after reading this article. Review the stop loss periodically, such as after significant technical or news events, to ensure it is still in a logical place given the market conditions. Assess Other Indicators: Use other technical indicators, like moving averages, to gain a clearer picture of the market’s direction. EToro has an amazing platform. While day trading can be conceptually straightforward buy low, sell high, successful execution requires intense focus and rapid decisions. Do you want to have more control by selecting your individual stocks yourself. Another approach you can use is harnessing put options, derivatives contracts that give you the ability to sell an underlying asset for a predetermined price within a specific time frame. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Complete Course on Options Trading. This book is also a great inspiration for those of you who think that you need a fancy degree to do well in trading. Day trading is most commonly found in stock and foreign exchange forex markets, where currencies are traded. The flag chart pattern occurs during a strong uptrend or downtrend in the market. We’ll match it to guarantee you the best value. Diversification in Investing.

Momentum Trading

In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches below. On a time based chart, each bar represents a set period, regardless of how many trades occurred. XYZ Ltd is trading at ₹550 per share, and you expect the share price to rise today. Bajaj Financial Securities Limited’s Associates may have actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report. It also helps in managing risk better by allowing traders to react swiftly to market changes. Before you begin to carry out trading transactions, make sure that you fully realize the risks associated with this type of activity. Simply put, it pays to get your terminology straight. Marketing partnerships. Bottom line: CMC Markets delivers a terrific mobile app experience. And notice the exchange rates have changed. It offers an identical trading experience on its mobile application as it does on its website, and includes the same wealth of asset types, including stocks, options, futures, indexes, forex, and cryptocurrencies. Once you have your brokerage account and budget in place, you can use your online broker’s website or app to place your stock trades. Here’s how to make your podcast stand out from the rest. See our methodology for more information on how we made this list. They tend to utilize Level 2 and time of sales windows to route orders to the most liquid market makers and ECNs for quick executions. Your security and privacy are our top priorities. The rise of DIY investing has empowered individuals to make their own investment decisions while saving on fees. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. App Downloads Over 1 crore. The required capital depends on factors like diversification, risk tolerance, and the markets you trade. We put a lot of effort into designing a simple and transparent trading platform that is easy to use yet offers the flexibility needed for today’s trading needs. Another form of risk management is the risk to reward ratio, which we just mentioned; this ratio is unique to each trader and states the amount a trader is willing to lose compared to how much they potentially want to make.

Fees

The morubozu candlestick pattern is achieved when a candle opens at the low or high of the previous candle and closes at the opposite end without leaving any wicks. We tell you to win predictions such as a mystery box real prizes of the Mantri mall, and your winning odds will increase with saturation. Daily statements will be sent to your email address if there is any deposit or withdrawal on your Paxos crypto trading account, or if you have any holdings. Featured Partner Offer. Hence, the position can effectively be thought of as an insurance strategy. Swing trading is an excellent trading form that many traders short on time resort to. I have brokerage accounts in Tradestation and Fidelity which I use to day trade on my phone. The regulation is designed to relieve downward pressure on a stock that’s already declining. I opened personal test accounts at all these brokers and checked pricing to find the very best. One of the most common uses of machine learning in trading is to develop predictive models that can forecast future market trends. The two basic categories of options to choose from are calls and puts. Day trading contrasts with the long term trades underlying buy and hold and value investing strategies. All financial investments involve an element of risk. In the fast paced world of trading, patience and rational decision making are vital. Hard commodities are mined substances like precious metals, diamonds, oils, gases, and the like. When combined with the ability to purchase fractional shares, commission free trading lets amateur traders gain a foothold in the market with very little upfront capital. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose unless otherwise expressly authorised. If you don’t already have an account, you can open one with an online broker in a few minutes. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Arbitrage is a type of scalping that seeks to profit from correcting perceived mispricings in the market. Written by Steven HatzakisEdited by John BringansFact checked by Joey ShadeckReviewed by Blain Reinkensmeyer. It allows traders to analyze how the order book evolved.

Symmetrical Triangle Patterns

Registering a trademark gives you the right to take legal action against anyone who uses your name without permission. The difference between the sales and the cost of goods sold is the gross profit or loss. Once you’ve got the basics down, our website’s analyse and learn section also contains a host of resources, including strategy and planning articles that help you perfect your technique and news and trade ideas to keep you up to date on current market events. However, it is essential to be patient and identify the critical support level to confirm a double top’s identity. Examples of such options include Nifty options, Bank Nifty options, etc. With that prerequisite aside, this book is one of the few out there that actually present “off the shelf” trading edges that you can start exploiting quickly. To protect yourself from becoming involved in dabba trading, either knowingly or unknowingly, consider the following tips. Theta is also known as a contract’s time value. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. Updated: Aug 30, 2024, 3:20am. Hope my trading game will improve with this new knowledge. But before you dive in, you should make sure you know how the stock market works and the details of trading in it. Using the format, you can understand sales in detail. What is Trade and Carry. It doesn’t matter if you’ve been trading for 3 years or 30 years, every person is susceptible to being influenced by emotions to some degree. A centralized exchange is a marketplace operated by a business entity that buys, sells and facilitates transactions in cryptocurrency. While you still get to keep the premium of $300, you’re at a net loss of $2,700 $50 per share less the premium. He elaborates on different types of indicators, candlesticks, and the formulas needed to build a successful methodology when trading. Countless online resources, courses, and communities are available to help you learn the ropes. For more information, see the developer’s privacy policy.

SIGN ME IN

For illustrative purposes only. Trading CFDs involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and further amounts. IG International Limited receives services from other members of the IG Group including IG Markets Limited. Buying the call gives you the right to buy the stock at strike price A. Our trading algorithms offer advanced features yet are the most user friendly and cost effective on the cryptocurrency market. Leverage from brokers can allow you to trade much larger amounts than your account balance. Based on client’s request the funds’ release request must be placed with the Clearing Corporation. Regular traders do not get the benefit of this feature. Charting on the IG Trading app is also rich with features. Efficiently manage multiple securities in one order with our innovative trading platform. Therefore, it’s a good idea to learn about each individual trading strategy and by combining different approaches to trading, you will become adaptive to each situation. Why we picked it: Options traders will appreciate that the broker charges no contract fee, which is still a relative rarity among brokers — especially ones that have the sort of advanced options trading features Firstrade offers. Learn more about what goes into options pricing. Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment. A trading account works as a ledger where all transactions related to the buying and selling of goods are recorded. Tradestation uses a coding language called “Easylanguage” and just as the name implies, it is very easy. The longer the pattern takes to develop and the larger the price movement within the pattern, the larger the expected move once the price breaks out. Get a diversified portfolio that’s monitored and managed for a low annual advisory fee of 0. It is easy to trade since the stock price movement is correlated with the index or sector. In Forex trading a common leverage ratio might be 50;1. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. For example, a 10 day SMA adds up the daily closing prices for the last 10 days and divides by 10 to calculate a new average each day. It’s important to understand, however, that, for small accounts, the monthly fees could outweigh the savings feature, depending upon the investor’s level of use. Stocks, which are also called equities, are securities that give shareholders an ownership interest in a public company. Here is a detailed comparison between Swing trading vs intraday trading. Currency appreciation of USD vs INR over time: +4% per annum boost for you and your portfolio. At The Motley Fool Ascent, brokerages are rated on a scale of one to five stars.

Robinhood

Measure advertising performance. Indeed, the volume of trades executed algorithmically has increased substantially over the years. Read full disclaimer here. This book covers the first topic, but Al has two other books that teach the other two patterns. However, it’s typically challenging for novices and often a losing way for newer investors to trade. Best In Class for Offering of Investments. How to Read Candlesticks Charts Easily. By allowing them to automate their quant strategies and sell them to investors and traders the world over. Kraken is one of the oldest U. Obviously, before jumping into the best crypto app reviews, we must first distinguish what makes an app the best crypto app out there. Just as you’d expect, the shooting star occurs at the end of an uptrend, giving you an opportunity to short the stock, expecting a reversal. Luckily, getting started on this journey is as easy as following these key steps. Just a word of warning. We can’t get US performance in Switzeralnd, but we can get good performance. A scintillating narrative of how one of the darlings of the hedge fund world rose and how it fell. 4 Outstanding expenses: Wages ₹ 1,400 and Salaries ₹ 1,600. Trading a lot bigger than they have done previously can lead to traders giving back the large profits they’ve made, and more. Our partners compensate us through paid advertising. Cashback rebates up to 15%.

Intraday Trading Timing in India

Instead, they can access multiple stock exchanges from any location around the world. Suppose a trader follows these simple trade criteria. Will allow you to monitor your finances in real time. How to Buy Stocks Online. If you’re going to day trade, It’s paramount to set aside a certain amount of money you can afford to lose. Machine learning techniques also help improve efficiency and reduce costs. It is not blocked through an asset purchase transaction. Ally Bank, the company’s direct banking subsidiary, offers an array of deposit, personal lending and mortgage products and services. These hold a basket of investments, so you’re automatically diversified. Tinker is one of the best option for freshers who entered in Stock Market and Safe Investment. Fewer still let you open other account types, including custodial accounts for kids and SEP IRAs for small business owners. The average of these payoffs can be discounted to yield an expectation value for the option. No order limit, Paperless onboarding. It’s essential to test your strategy thoroughly and make any necessary adjustments before you start trading with real money. Minor price movements are less of a concern, and you will tend to have fewer open trades, potentially of a higher value. While we adhere to strict editorial integrity , this post may contain references to products from our partners. You need an account with a leveraged trading provider, like IG, to trade CFDs. Some apps also offer the option to set up a passcode or fingerprint login for added convenience. Market Access: Trading apps provide access to various financial markets, including stock exchanges e. 12088600 NSDL DP No.

NSE NMFII

If you plan to re enter the market at a sunnier time, you’ll almost certainly pay more for the privilege and sacrifice part if not all of the gains from the rebound. At the core of Acorns’ strategy is its Round Ups feature, which enables users to automatically invest their “spare change” with every debit or credit card purchase. Reddit and its partners use cookies and similar technologies to provide you with a better experience. By downloading and using a color trading app, you can explore the vibrant world of digital color trading, whether as a creative outlet, an investment opportunity, or a way to connect with a community of like minded individuals. It’s pretty great and free trading apps are perfect for beginners and the pros. What Percent Of Your Income Can Go For Mutual Funds. Depending on the exchange, maker fees are usually slightly less than taker fees, although this isn’t always the case. AlphaSense uses AI trading technology like natural language processing and machine learning to comb through thousands of documents, market reports and press releases. In other words, all traders do when they add indicators to their charts is produce more variables for themselves; they aren’t gaining any insight or predictive clues that aren’t already provided by the market’s raw price action. While the broker’s account selection is limited, it lets you open either account at no additional cost except small clearing firms and regulatory agency fees. They would have kept the trader in for the entire rally starting in March. This article elaborates on the aforementioned types of trading in the share market. 02 below a recent swing low if buying a breakout, or $0. With Neostox, you have the tools to learn, practice, and perfect your trading with zero risk. A stochastic oscillator is another type of momentum indicator, like RSI. They’ll do their due diligence, research before placing a trade, read charts, study trends; and the broker will act on their behalf.

Categories:

Company News